☐ April 8, 2024 www.virtualshareholdermeeting.com/ECVT2024. 8. NOTICE OF ANNUAL MEETING OF STOCKHOLDERS Stockholders of record at the close of business on March If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page. PROXY STATEMENT This Proxy Statement provides information for stockholders of This Proxy Statement, the proxy card and the Annual Report to stockholders for the fiscal year ended December 31, 8, 2024. A list of stockholders will be available at our headquarters at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 for a period of at least ten days prior to the Annual Meeting. Beneficial owner of shares held in street name: If your shares are held in a brokerage account or by a bank or other nominee, then you are the “beneficial owner of shares held in street name” and the proxy materials were forwarded to you by your broker, bank or other nominee, who is considered to be the stockholder of record. As a beneficial owner, you have the right to instruct the broker, bank or other nominee holding your shares how to vote your shares. All shares represented by valid proxies received prior to the taking of the vote at the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. Even if you plan on attending the Annual Meeting then the A broker, bank or other nominee may generally vote in their discretion on routine matters, and therefore no broker non-votes are expected in connection with Proposal 4. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that broker, bank or other nominee will inform the inspector of election that it does not have the authority to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.” Therefore, broker non-votes may exist in connection with Proposals 1, 2, 3 and 5. 2024. Proposals 1, 2 and 3. No broker non-votes are expected in connection with Proposal 4. Broker non-votes and abstentions will have the same effect as an “against” vote on Proposal 5. The Board has included the proposed declassification of the Board via the Charter Amendment on the ballot for the 2024 annual meeting of stockholders (Proposal 5). If Proposal 5 is approved by our stockholders, we will begin a process of declassifying the Board, which will be completed at the 2027 annual meeting of stockholders. Following the 2027 annual meeting of stockholders, the Board will consist of one class elected to one-year terms. Class III – Directors with Terms Expiring in Annual cash retainers are paid quarterly in arrears. our stock ownership guidelines: Board. trends that impact public company boards. The Chief Executive Officer reviews succession planning and management development with the Board and the Nominating and Corporate Governance Committee on an annual basis. This succession planning includes the development of policies and principles for selection of the Chief Executive Officer, including succession in the event of an emergency or retirement. In general, the Board does not have a policy limiting the number of other public company boards of directors upon which a director may sit. However, the Nominating and Corporate Governance Committee shall consider the number of other boards of directors (or comparable governing bodies), particularly with respect to public companies, on which a prospective nominee is a member. Although the Board does not impose a limit on outside directorships, it does recognize the substantial time commitments attendant to membership on the Board and expects that directors devote all such time as is necessary to fulfill their accompanying responsibilities, both in terms of preparation for, and attendance and participation at, meetings. Biographical information concerning Kurt J. Bitting, our The percentage ownership information shown in the table below is based upon 21, 2024. 2023. The below. 2023. Compensation Decision Making Process interest related to the Company. Elements of Compensation in 2023 Base Salary Annual Performance-Based Cash Awards – The Stock Ownership Guidelines for Executive Officers Prior to January 1, 2018, certain compensation that qualified as “performance-based” was exempted from the above deductibility limits under Section 162(m). However, the Tax Cuts and Jobs Act of 2017 generally eliminated the performance-based compensation exception, with certain limited grandfathering TABLE OF CONTENTS Retirement Plan Benefits the board of directors of Ecovyst Advanced Materials and Catalysts LLC. lump sum on the first to occur of the participant’s separation from service or disability, provided that distributions to “key employees” within the meaning of Section 416(i) of the Internal Revenue Code as of the date of the participant’s separation from service will not be made until six (6) months after the participant’s separation from service or, if earlier, the participant’s death. IN THE FUTURE We last held a stockholder advisory vote on the frequency of say-on-pay proposals in 2018, when stockholders recommended that a stockholder advisory votes on executive compensation occur every year. The Board has included a stockholder advisory vote on executive compensation on the annual meeting ballot each year since 2018. SEC. The Audit Committee pre-approves all audit services and all permitted non-audit services, including engagement fees and terms, to be provided by the independent auditors. Our policies prohibit www.ecovyst.com. www.equiniti.com. At the time of mailing of this Proxy Statement, we do not know of any other matter that may come before the Annual Meeting and do not intend to present any other matter. However, if any other matters properly come before the meeting or any adjournment, the persons named as proxies will have discretionary authority to vote the shares represented by the proxies in accordance with their own judgment, including the authority to vote to adjourn the meeting. CERTIFICATE OF AMENDMENToooooPQ GROUP HOLDINGS INC.No fee required.oFee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.1)Title of each class of securities to which transaction applies: 2)Aggregate number of securities to which transaction applies: 3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): __________________4)Proposed maximum aggregate value of transaction: 5)Total fee paid: oFee paid previously with preliminary materials.oCheck box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.1)Amount Previously Paid: 2)Form, Schedule or Registration Statement No.: 3)Filing Party: �� 4)Date Filed:

5, 201820182024 Annual Meeting of Stockholders on Friday,Wednesday, May 4, 2018,8, 2024 at 10:008:30 a.m. (Eastern Time), to be heldconducted exclusively via live webcast at our offices at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355.4th.

James F. GentilcoreChairman, President

20182024 PROXY STATEMENT

20182024 Annual Meeting of Stockholders (the “Annual Meeting”) of PQ Group HoldingsEcovyst Inc. (the “Company”) will be helda virtual meeting conducted exclusively via live webcast at our officeswww.virtualshareholdermeeting.com/ECVT2024 on Wednesday, May 8, 2024 at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 on Friday, May 4, 2018, at 10:008:30 a.m. (Eastern Time) for the following purposes as further described in the proxy statementProxy Statement accompanying this notice:the say-on-pay proposaladvisory votes on executive compensation in the future.2018.2024.29, 201821, 2024 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.To attend the Annual Meeting, you must demonstrate that you were a PQ stockholder as of the close of business on March 29, 2018, orvalid proxy for the Annual Meetingvirtual annual meeting in 2024 in order to facilitate stockholder attendance and participation by enabling stockholders to participate from such a stockholder. The proxy card includes an admission ticketany location and at no cost. You will be able to attend the Annual Meeting. You may alternatively present a brokerage statement showing proof ofmeeting online, vote your ownership of PQ stock as of March 29, 2018. All stockholders must also present a valid form of government-issued picture identificationshares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/ECVT2024. To participate in orderthe virtual meeting, you will need the control number included on your proxy card or voting instruction form. The meeting webcast will begin promptly at 8:30 a.m. (Eastern Time). We encourage you to attend. Pleaseaccess the meeting prior to the start time. Online check-in will begin at 8:15 a.m. (Eastern Time), and you should allow additionalample time for thesethe check-in procedures.

5, 201820182024 PROXY STATEMENT

20182024 PROXY STATEMENT

PQ GROUP HOLDINGS INC.20184, 201810:008, 2024INTRODUCTIONPQ Group HoldingsEcovyst Inc. (“we,” “us,” “our,” “PQ”“Ecovyst” and the “Company”), as part of the solicitation of proxies by the Company and its board of directors (the “Board”) from holders of the outstanding shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), for use at the Company’s annual meeting of stockholders to be held as a virtual meeting conducted exclusively via live webcast at our officeswww.virtualshareholdermeeting.com/ECVT2024 on Wednesday, May 8, 2024 at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 on Friday, May 4, 2018 at 10:008:30 a.m. (Eastern Time), and at any adjournments or postponements thereof (the “Annual Meeting”).1. To elect the three Class I director nominees specifically named in this Proxy Statement, each to serve for a term of three years (Proposal 1). 2. To hold an advisory vote on the compensation paid by the Company to its named executive officers (the “say-on-pay proposal”) (Proposal 2). 3. To hold an advisory vote on the frequency of the say-on-pay proposaladvisory votes on executive compensation in the future (Proposal 3).4. To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 20182024 (Proposal 4).5. 5.To amend the Second Restated Certificate of Incorporation, as amended and corrected (the “Charter”), to declassify the Board of Directors (the “Board”) of the Company (the “Charter Amendment”) (Proposal 5).6. To consider any other business properly brought before the Annual Meeting. 20172023 are being first mailed to stockholders on or about April 5, 2018.4, 2018:8, 2024: THIS PROXY STATEMENT, ANDTHE ANNUAL20172023 ARE AVAILABLE AT WWW.PROXYVOTE.COM.20182024 PROXY STATEMENT

take placebe a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ECVT2024 on May 4, 20188, 2024 at our offices at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 at 10:008:30 a.m. (Eastern Time). Stockholders are invited to participate inattend the Annual Meeting online and are requested to vote on the proposals described herein.fourfive proposals scheduled to be voted on at the Annual Meeting:theThe election of the three Class I director nominees specifically named in this Proxy Statement, each to serve for a term of three years;anAn advisory vote on the say-on-pay proposal;anAn advisory vote on the frequency of the say-on-pay proposaladvisory votes on executive compensation in the future; andtheThe ratification of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018.2024; and29, 2018.21, 2024. You may cast one vote per share, including shares (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a broker, bank, or other nominee. The proxy card will indicate the number of shares that you are entitled to vote.

29, 2018,21, 2024, there were 135,240,866116,991,445 shares of Common Stock outstanding, all of which are entitled to be voted at the Annual Meeting.Meeting and at the Annual Meeting for examination by any stockholder.PQ’sEcovyst’s transfer agent, American Stock Transfer andEquiniti Trust Company, LLC, you are the stockholder of record with respect to those shares and the proxy materials were sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individualsindividual named on the proxy card and to vote at the Annual Meeting.2

2018 PROXY STATEMENTIn Person. You may vote in person at the Annual Meeting by requesting a ballot from an usher. If you are a beneficial owner of shares held in street name and wish to vote in person at the Annual Meeting, you must obtain a “legal proxy” from the broker, bank or other nominee that holds your shares. A legal proxy is a written document that authorizes you to vote your shares held in street name at the Annual Meeting. Please contact the broker, bank or other nominee that holds your shares for instructions regarding obtaining a legal proxy. You must bring a copy of the legal proxy to the Annual Meeting. In order for your vote to be counted, you must hand both the copy of the legal proxy and your completed ballot to an usher to be provided to the inspector of election.• • • • Phone. You may vote by proxy by calling the toll free number found on your proxy card. The availability of phone voting may depend on the voting procedures of the broker, bank or other nominee that holds your shares.Mail. You may vote by proxy by filling out your proxy card and returning it in the envelope provided.in person,online, we encourage you to vote your shares in advance online, by phone, or by mail to ensure that your vote will be represented at the Annual Meeting.In Person. You may revoke your proxy and change your vote by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you properly vote at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation prior to the Annual Meeting to PQ’s Secretary at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355.Online. You may change your vote using the online voting method described above, in which case only your latest internet proxy submitted prior to the Annual Meeting will be counted.Phone. You may change your vote using the phone voting method described above, in which case only your latest telephone proxy submitted prior to the Annual Meeting will be counted.Mail. You may revoke your proxy and change your vote by signing and returning a new proxy card dated as of a later date, in which case only your latest proxy card received prior to the Annual Meeting will be counted.• • • • 20182024 PROXY STATEMENT

personsperson named as proxy holders,holder, Joseph S. Koscinski, and William J. Sichko, Jr., will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as theyhe may determine in theirhis best judgment with respect to any other matters properly presented for a vote at the Annual Meeting.20182024 (Proposal 4). andthe say-on-pay proposaladvisory votes on executive compensation in the future (Proposal 3); andthrough 3.in persononline or by proxy, of the holders of Common Stock representing a majority of the shares outstanding and entitled to vote for the election of directors is necessary to constitute a quorum for all purposes.the say-on-pay proposaladvisory votes on executive compensation in the future.Because this proposal also calls for a non-binding, advisory vote, there is no “required” vote that would constitute approval. If none of the frequency options receives the vote of a majority of the votes cast on the matter, the option receiving the greatest number of votes will be considered the frequency recommended by the Company’s stockholders.

20182024 PROXY STATEMENT 2018.each proposal.salaries.compensation. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy materials to their principals and to request authority for the execution of proxies. We may reimburse these personsbanks, brokers and other custodians for their expenses in doing so.(610) 651-4216(484) 617-1200 or send an email to PQGIR@pqcorp.com.20182024 PROXY STATEMENT

PQ currently consisting of three directors with terms expiring in 20182024 (Class I), fourthree directors with terms expiring in 20192025 (Class II), and fourthree directors with terms expiring in 20202026 (Class III). AtCurrently, at each annual meeting of stockholders, directors in one class are elected for a full term of three years to succeed those directors whose terms are expiring. Greg Brenneman, Jonny GinnsAnna C. Catalano, Sarah Lorance and Kyle Vann are the current Class I directors whose terms expire at the Annual Meeting. Mr. Vann has decided not to stand for re-election in accordance with the Board’s Director Retirement Policy.re-elect, Messrs. Brenneman, Ginnselect, Ms. Catalano and VannMs. Lorance for three-year terms expiring at our 20212027 annual meeting of stockholders. The Board has also nominated Donald Althoff for election as a Class I director for a three-year term expiring at our 2027 annual meeting of stockholders.20212027 annual meeting of stockholders and a successor is duly elected and qualified or until earlier death, resignation, or removal.All of our nominees have served previously on our Board, which has provided them with significant exposure to both our business and the industry in which we compete. boardBoard service, and we have highlighted particularly noteworthy attributes for each director in the individual biographies below.position,class, as of AprilMarch 1, 2018,2024, of individuals who currently serve as directors on our Board. James F. GentilcoreAnna C. Catalano 6564Chairman of the Board, President and Chief Executive OfficerGreg Brenneman56 Timothy WalshSarah Lorance 5450 Mark McFaddenKyle Vann 4076 Robert Toth57Director 7076 Andrew CurrieSusan F. Ward 6263 Jonny GinnsBryan K. Brown 4456 Kyle VannClass II70Director Martin CraigheadKevin M. Fogarty DirectorNon-Executive Chairman Kimberly RossKurt J. Bitting 5248

20182024 PROXY STATEMENT

20182024

GREG BRENNEMAN

56

64 Greg BrennemanAnna C. Catalano has served on our Board since 2014. Mr. Brenneman is the Executive ChairmanJuly 2022. Ms. Catalano has over 30 years of CCMP Capital Advisors, LP (“CCMP”)business experience, including senior roles at BP plc and is a memberits predecessor company, Amoco Corporation, until her retirement in 2003 and two decades of the firm’s Investment Committee. Prior to joining CCMP in October 2008, Mr. Brenneman served as the Chief Executive Officer of QCE Holdings LLC (“Quiznos”), a U.S. quick service restaurant chain, from January 2007 untilpublic and private board service. In September 2008, she co-founded The World Innovation Network, a nonprofit network of innovators to work toward global prosperity, and as the President of Quiznos from January 2007continued to work with that organization until November 2007. He also served as the Executive Chairman from 2008 to 2009. Prior to joining Quiznos, Mr. Brenneman was the Chairman and Chief Executive Officer of Burger King Corporation from 2004 to 2006. Prior to joining Burger King, Mr. Brenneman was named the President and Chief Executive Officer of PwC Consulting in June 2002. Mr. Brenneman joined Continental Airlines in 1995 as the President and Chief Operating Officer and as a member of its board of directors. In 1994, Mr. Brenneman founded Turnworks, Inc., his personal investment firm that focuses on corporate turnarounds. Prior to founding Turnworks, Mr. Brenneman was a Vice President for Bain and Company. Mr. Brenneman currently serves on the board of directors of The Home Depot, Inc. and Baker Hughes, a GE Company. Mr. Brenneman previously2021. Since 2017, she has served on the board of directors of Milacron Holdings Corp.HF Sinclair Corporation, where she is a member of the Nominating, Governance and Social Responsibility and Compensation Committees. Since 2018, she has served on the board of directors of Frontdoor, Inc., where she is the chair of the Compensation Committee. Since May 2022, she has served on the board of directors of Hexion, Inc. Previously, she served on the boards of directors of Willis Towers Watson from 2012June 2006 until 2017, Automatic Data Processing, Inc. from 2001 until 2014 and Francesca’s HoldingJune 2022, Kraton Corporation from September 2011 until March 2022, Mead Johnson Nutrition from May 2010 until 2015.June 2017 and Chemtura Corporation from March 2011 until May 2017. Because of his leadershipher experience over 20 yearsin, and knowledge of, business experiencethe refining sector, including with respect to both traditional and renewable fuels, and extensive experience serving as both a public and private company director, we believe Mr. BrennemanMs. Catalano is well qualified to serve on our Board.

JONNY GINNSAge: 44Independent DirectorJonny Ginns has served on our Board since 2010. Mr. Ginns joined INEOS Group, an affiliate of INEOS Investments Partnership (“INEOS”) in 2006 as the Group General Counsel, having worked as an external lawyer for a number of years before that. He has experience across a wide range of fields, including mergers & acquisitions, disposals, joint ventures, litigation, finance and employee benefits, and acts as a director for a number of INEOS entities. Because of his significant core business skills, including financial and strategic planning, we believe Mr. Ginns is well qualified to serve on our Board.

KYLE VANNAge: 70Independent Directoris an Executive Advisor to CCMP since October 2012 and has provided consulting services to Entergy Corporation since 2005.between January 2005 and October 2020. He also served for 25 years in various senior leadership positions at Koch Industries, including as the Chief Executive Officer of Entergy-Koch LP, a joint venture between Koch Industries and Entergy Corporation. Before joining Koch Industries, Mr. Vann worked at Humble Oil and Refining Company (which later became part of Exxon) as a refinery engineer. Mr. Vann formerly served on the board of directors of EnLink Midstream, LLC from January 2019 until March 2023. From 2006 to January 2019, he served on the boards of EnLink Midstream Partners LP. and Legacy Reserves LP. Mr. Vann is not standing for re-election to the Board in accordance with the Board’s Retirement Policy.

EnLink Midstream Partners LPVSP Vision since January 2024, where she is a member of the Finance and Legacy Reserves LP. BecauseAudit Committees. Ms. Lorance also currently serves on the board of his extensive experiencedirectors of the Knoebel Institute of Healthy Aging at the University of Denver since September 2023, where she is an Advisory Board Member. She holds a B.B.A. degree in explorationAccounting from the University of Iowa. She also is a certified public accountant and production, midstream, energy services and trading, we believe Mr. Vann is well qualifiedNACD Directorship Certified®. She was appointed to serve on our Board.the Board as a result of her finance, risk management, compliance and general business experience.2018(1)Mr. Vann is not related to George Vann, our Vice President and President - Ecoservices.

20192025

70

76 world leading global catalyst company. From 2003 until 2017, Mr. Coxon served as the Chairman of the UK CenterCentre for Process Innovation, an international research center in printable electronics, bio-processing and low carbon energy. Mr. Coxon previously served on the board of directors of AZ Electronic Materials SA, Jiangsu Sinorgchem Technology Co., Ltd., Ensus Ltd. and Stahl Holdings BV. Because of his extensive experience in the chemicals sector, we believe Mr. Coxon is well qualified to serve on our Board.

MARK MCFADDEN

40

63 Mark McFaddenSusan F. Ward has served on our Board since 2016. Mr. McFadden is2020. A respected accounting professional, Ms. Ward spent 27 years serving in a Managing Directorvariety of CCMP and focuses on making investmentsroles at United Parcel Service, Inc., most recently as its Chief Accounting Officer from 2015 until her retirement in the industrial sector.August 2019. Prior to joining CCMP upon its formationher tenure at UPS, Ms. Ward spent 10 years at Ernst & Young in August 2006, Mr. McFadden was with J.P. Morgan Partners, LLC between 2002 and 2006. Prior to that, Mr. McFadden was an investment banking analyst at Credit Suisse First Boston and Bowles Hollowell Conner. Mr. McFadden currently servesAssurance Services. Ms. Ward has served on the board of directorsSaia, Inc. since November 2019 and currently serves as the chairperson of Milacron Holdings Corp. Becauseits Audit Committee. Since September 2021, she also has served as a member of his extensive experience in the industrial sectorboard of Global Business Travel Group, Inc., where she also serves as chairperson of its Audit Committee and his significant experience in,as a member of its Risk Management and knowledge of, corporate finance and strategic development, we believe Mr. McFadden is well qualifiedCompliance Committee. She was elected to serve onas a member of our Board.Board as a result of her years of experience as a senior financial executive of a multi-national business, as well as her public accounting experience.

KIMBERLY ROSS

52

56 Kimberly RossBryan K. Brown has served on our Board since 2017. Ms. RossApril 2022. Mr. Brown has served as the Senior Vice President and Chiefa partner at Jones Day in its Financial Officer of Baker Hughes Incorporated, a supplier of oilfield services from 2014 to 2017.Markets – Capital Markets practice since 2019. Prior to joining Baker Hughes Incorporated in November 2014, Ms. RossJones Day, Mr. Brown served as the Executive Vice Presidenta partner at Reed Smith from November 2013 to April 2019, at Thompson Knight from March 2012 to November 2013, and Chief Financial OfficerPorter Hedges from May 1998 to February 2012. Mr. Brown currently serves as a member of Avon Products Incorporated, a manufacturer of beauty products, from 2011 to 2014. Prior to joining Avon Products, Ms. Ross was an Executive Vice President and the Chief Financial Officer of Royal Ahold N.V., a food retailer, from 2007 to 2011 and held various other finance positions with Royal Ahold N.V. from 2001 to 2007. Ms. Ross serves on the board of directorsadvisors of the College of Business at Sam Houston University and The John Cooper School, where he is a member of the audit committeeAudit Committee. Prior to entering private practice, Mr. Brown worked at the Division of Chubb Limited.Corporate Finance at the U.S. Securities and Exchange Commission. Mr. Brown is an active member of the National Association of Corporate Directors (“NACD”), and has completed NACD Directorship Certified® program. Because of herhis extensive financial expertiseexperience advising public companies and his extensive leadership experience, we believe Ms. Rossthat Mr. Brown is well qualified to serve on our Board.

20182024 PROXY STATEMENT

ROBERT TOTHAge: 57Independent DirectorRobert Toth has served on our Board since 2016. Mr. Toth is a Managing Director of CCMP. Prior to joining CCMP in 2016, Mr. Toth served as the Chief Executive Officer and President of Polypore International, Inc., a leading global high technology filtration company specializing in microporous membranes, since 2005, during which time Polypore transitioned from a private to a public company via a successful IPO in 2007 and was ultimately acquired in 2015. Mr. Toth was previously the President and Chief Executive Officer and a member of the board of directors of CP Kelco ApS, a global leader in the specialty hydrocolloids market. Prior to joining CP Kelco in 2001, Mr. Toth spent 19 years at Monsanto Company and Solutia Inc. where he held a variety of managerial and executive roles. Mr. Toth currently serves on the board of directors of Materion Corporation and SPX Corporation. Mr. Toth previously served on the board of directors of Polypore International, Inc. from 2005 until 2015. Because of his extensive leadership experience and past service as a public company director, we believe Mr. Toth is well qualified to serve on our Board.2020

JAMES F. GENTILCOREAge: 65Director, Chairman, President and CEO James F. Gentilcore became a director and our President in July 2016 and became our chairman of the Board in December 2017. Mr. Gentilcore most recently served as an Executive Advisor to CCMP from April 2014 to June 2016. He previously served as Chief Executive Officer of Edwards Group Limited, a developer and manufacturer of vacuum products, abatement systems and related services, from March 2013 to January 2014, and as a director from December 2007 until January 2014. Prior to that, he was the Chief Executive Officer of EPAC Technologies Inc., a logistics technology solutions company, from January 2009 until March 2011. Mr. Gentilcore also served as Chief Operating Officer of Brooks Automation Inc., a position he held from November 2005 until November 2007, after leading the merger between Brooks and Helix Technology Corp., where he had been the Chief Executive Officer from December 2002 until October 2005. Prior to that, Mr. Gentilcore was the Chief Operating Officer of Advanced Energy Industries, Inc. Earlier in his career, he spent 10 years in the electronics materials industry with Air Products Inc., serving in various business development and operational roles. Mr. Gentilcore currently serves on the board of directors of Entegris, Inc. and Milacron Holdings Corp. and previously served as a member of the board of directors of KMG Chemicals Inc. from May 2014 to December 2016. Because of his more than 40 years of management experience and his current leadership of the company as our President and Chief Executive Officer, we believe Mr. Gentilcore is well qualified to serve on our Board. 2018 PROXY STATEMENT

9

MARTIN CRAIGHEADAge: 58Independent DirectorMartin CraigheadKurt J. Bitting has served on our Board since 2017.April 2022. Mr. Craighead served as theBitting became our Chief Executive Officer of Baker Hughes Incorporated, a supplier of oilfield services, from 2012in April 2022. Prior to 2017. He has alsothat, he served as ChairmanVice President and President—Ecoservices (formerly Refining Services) beginning in March 2019. From September 2017 until February 2019, Mr. Bitting served as Vice President of Eco Services. Between May 2016 and August 2017, he was Business Director in the board of directors of Baker Hughes Incorporated from 2013Eco Services business. Mr. Bitting also previously held management positions at Kinder Morgan, Inc., Sprint Corporation, Solvay USA Inc. and Eco Services Operations LLC. Mr. Bitting began his career in the U.S. Army where he served as a Company Commander in the 10th Mountain Division. Mr. Bitting was elected to 2017 and wasserve as a member of their board of directors from 2011 until 2017. Mr. Craighead currently serves on the board of directors of Baker Hughes, a GE company, following the combination of Baker Hughes with GE’s oil and gas business. He first joined Baker Hughes Incorporated in 1986 and was its Chief Operating Officer from 2009Board due to 2012 and Group President of drilling and evaluation from 2007 to 2009. He also served as President of INTEQ from 2005 to 2007 and President of Baker Atlas from February 2005 to August 2005. Because of his industry expertise in the energy sector and extensive management experience, we believe Mr. Craighead is well qualified to serve on our Board.and leadership experience.

ANDREW CURRIE

62

53 Andrew CurrieDavid A. Bradley has served on our Board since 2008.April 2022. Since March 2019, Mr. CurrieBradley has served as the President and Chief Executive Officer and member of the board of directors of SI Group. Prior to joining SI Group, Mr. Bradley served as President and CEO and member of the board of directors of Nexeo Solutions between 2011 and 2019. Prior to that, Mr. Bradley spent seven years at Kraton Corporation, where he held several executive positions, including Chief Operating Officer, Vice President of Global Operations, and Vice President of Business Transformation. Since 2019, he also has been a director of INEOS since 1999, a partner of INEOS since 2000 and a director of INEOS AG since March 2010 when the ownershipmember of the INEOS business was transferred to Switzerland. He was previously a Managing Directorboard of Laporte Performance Chemicals, having served as a directordirectors of the Inspec Group from 1994 until the Laporte acquisition of Inspec in 1998. Mr. Currie spent the first 15 yearsSouth Texas Truck Centers LLP. Because of his career with BP Chemicals in various technical and business management functions. Because of hisextensive experience in the chemicals sector and his significant core business skills, including financialextensive management and strategic planning,leadership experience, we believe Mr. CurrieBradley is well qualified to serve on our Board.

TIMOTHY WALSH

54

58 Timothy Walsh hasKevin M. Fogarty became a director and our Chairman in April 2022 and he became chairman of our Nominating and Corporate Governance Committee in July 2022, serving in that position until December 31, 2023. From January 2008 until March 2022, Mr. Fogarty served on our Board since 2014. Mr. Walsh is theas Kraton Corporation’s President and Chief Executive Officer and as a member of CCMPits board of directors from September 2009 until March 2022. From May 2005 to December 2007, he served as Kraton’s Executive Vice President of Global Sales and Marketing. From May 2004 to April 2005, Mr. Fogarty served as President, Polymers and Resins, of Invista. From 1991 to April 2004, Mr. Fogarty held a variety of roles within the Koch Industries, Inc. family of companies. Mr. Fogarty serves as Chairman of the board of directors of P.H. Glatfelter Company, where he also is a member of the firm’s Investmentits Compensation Committee and formerly served on its Nominating and Corporate Governance Committee. Mr. Walsh focuses on making investments in the industrial sector. Prior to joining CCMP upon its formation in August 2006, Mr. Walsh was with J.P. Morgan Partners, LLC and its predecessors from 1993 until 2006. Prior to that, Mr. Walsh worked on various industry-focused client teams within The Chase Manhattan Corporation. Mr. Walsh currently servesSince 2022, he also has served on the board of directors of Milacron Holdings Corp.OPAL Fuels Inc., where he also serves on its Audit and previouslyCompensation Committees. He formerly has served as a memberdirector of the board of directors of Generac Holdings Inc. from 2006 until 2016.American Chemistry Council. Because of his knowledge ofextensive experience in the industrialchemicals sector and his extensive experience in businessmanagement and finance,leadership experience, we believe Mr. WalshFogarty is well qualified to serve on our Board.10

20182024 PROXY STATEMENT

connectionaccordance with our non-employee director compensation policy, which has been in place since the time of our initial public offering, we adopted a non-employee director compensation policy setting forth the compensation of our independent non-employee directors effective beginning immediately following our initial public offering. Pursuant to such policy, each of our non-employee directors who is not an employee of CCMP Capital Advisors L.P. (“CCMP”) or INEOS Limited (“INEOS”) is compensated as follows:audit committeeAudit Committee receives an additional annual cash retainer of $20,000. Each annual retainer is paid quarterly in arrears.a writtenan award agreement between each director and us, which generally provides for vesting after one year of continued service as a director or upon an earlier occurrence of a change in control.PQ Group HoldingsEcovyst Inc. 2017 Omnibus Incentive Plan, as amended and restated (the “2017 Plan”).2017, prior to our initial public offering, Mr. Coxon, as an independent non-employee director, was paid an annual cash fee and an additional fee for his service as chairperson of the Health, Safety and Environment Committee of our Board in the amounts set forth above.Other than to Mr. Boyce, in 20172023, we did not pay any additional remuneration for director service to any of our directors who were either our officers or who were employees of CCMP or employees of INEOS. However, all directors were reimbursed for reasonable travel and lodging expenses incurred to attend meetings of our Board or a committeecommittees thereof.August 15, 2017,January 16, 2023, the Company granted 20,325 restricted stock units to each of our two newly appointed directors, Mr. CraigheadMessrs. Bradley, Brown, Coxon and Vann and to Ms. Catalano and Ms. Ross, 12,375 restricted shares.Ward. Each award vestsvested subject to the director’s continued service through January 5, 2024 (or upon an earlier occurrence of a change in control). The Compensation Committee also approved, and the Company granted on January 16, 2023, 1,016 shares of stock to each of Messrs. Brown, Coxon and Vann for their service on the Special Repurchase Committee of the director throughBoard and 2,033 shares of stock to Ms. Ward for her service as Chair of the first anniversary of his or her appointment to our BoardSpecial Repurchase Committee. In addition, on July 12, 2017.In connection with our initial public offering, Mr. Coxon and Mr. Vann were each awarded 11,786January 16, 2023 the Company granted 40,650 restricted stock units which awards vestto Mr. Fogarty, consisting of 20,325 restricted stock units for his service on the first anniversaryBoard and 20,325 restricted stock units as a part of the datefee differential for his service as Non-Executive Chair of grant,the Board. Each award of restricted stock unit vested subject to the director’s continued service asthrough January 5, 2024 (or upon an earlier occurrence of a director, and Mr. Boyce received a grant of 21,607 shares that was fully vested on the date of grant.Retirement of Mr. BoyceMr. Boyce retired as the ChairmanBoardnon-employee directors is expected to have ownership of Company stock in an amount equal to at least $625,000. Non-employee directors subject to the conclusion of our December 2017 Board meeting.Priorguidelines have five years to his retirement, Mr. Boyce had been partyachieve the required ownership levels and, until they satisfy their ownership requirements, are subject to an agreementa holding requirement with the Company pursuant to which he received an annual base salary of $357,500, which was equalrespect to 50% of the annual base salary he received atshares they acquire upon the timevesting or exercise of his resignation as Chief Executive Officer, as well asequity-based awards (on an annual incentive bonus with a target of 100% of his annual base salary, basedafter-tax basis). Non-employee directors who do not receive compensation for their service on the Company’s achievement of financial performance goals established by our Board or the Compensation Committee. As a member of our Board, Mr. Boyce participated in the determination of the objective financial targets upon which payments under the PQIP, our annual incentive plan, were based, but Mr. Boyce didare not otherwise participate in the determination of the level of compensation he was awarded. Until his retirement, Mr. Boyce remained eligiblesubject to participate in any employee benefit plans and programs maintained by the Company, to the extent permitted under the applicable plans. Any equity awards he held at the time he ceased to be our Chief Executive Officer continued to vest based on his services as Chairman.201810

11

On August 31, 2017, Mr. Boyce entered into a severance and release agreement with us setting forthterms and conditionsownership of his retirement in December 2017. Subject to his continued compliance with the restrictive covenants set forth in his agreement, upon his retirement, Mr. Boyce received a lump sum severance payment equal to $1,430,000, which represents two times the amountour Common Stock as of his base salary and target annual incentive bonus, and he will receive his 2017 annual incentive bonus of $223,438 in accordance with the terms of the PQIP. Mr. Boyce is also entitled to continued participation in the Company’s health plan at active employee rates for 24 months. In addition, for the period January 1, 2018 through and including December 31, 2019, all unvested equity awards held2023 by Mr. Boyce will continueour non-employee directors who were serving on our Board as of December 31, 2023 and who are subject to be eligible to vest pursuant to the terms of the award agreements and equity incentive plans governing such unvested awards. (1) Calculated using the average closing price of $9.52 during the 90-day period preceding December 31, 2023, in accordance with the terms of our stock ownership guidelines. Ownership multiples are rounded to the nearest one-hundredth. (2) Ms. Catalano joined our Board on July 27, 2022 and therefore has until July 27, 2027 to satisfy the stock ownership requirement. (3) Mr. Bradley joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement. (4) Mr. Brown joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement. (5) Mr. Fogarty joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement, although he satisfied the requirement as of December 31, 2023. (6) Ms. Ward joined our Board on June 1, 2020 and therefore has until June 1, 2025 to satisfy the stock ownership requirement, although she satisfied the requirement as of December 31, 2023. 2017. Mr. Gentilcore does not receive any additional compensation for his services as a director and his compensation as an employee is reflected in the 2017 Summary Compensation Table.2023. Directors who arewere employees of CCMP or INEOS dodid not receive compensation.

or Paid

in Cash

($)(2)

Awards

($)(3)(4)

Incentive Plan

Compensation

($)(5)

Compensation

($)(6)

($) (1) (1)Mr. Behrens resigned as a member of our Board on September 18, 2017. Mr. Boyce resigned as a member of our Board on December 12, 2017.(2)Mr. Boyce received compensation for his service as Chairman pursuant to the agreementAs described above. Mr.above, Ms. Ward and Messrs. Fogarty, Bradley and Coxon and Ms. Ross received an additional annual retainer for their servicesservice as committee chairs. Ms. Ward served as chair of the Audit Committee and received an additional retainer of $20,000 for such service. Mr. Fogarty served as chair of the Nominating and Corporate Governance Committee and received an additional annual retainer of $15,000 for such service. Mr. Bradley served as chair of the Compensation Committee beginning on May 10, 2023 and is entitled to receive an additional annual retainer of $15,000 for such service. The actual amount paid to Mr. Bradley for his service as chair of the Compensation Committee in 2023 was $9,642.86. Mr. Coxon served as the chair of the Health, Safety, Environment and EnvironmentSecurity Committee and Ms. Ross servedreceived an additional retainer of $15,000 for such service. As described above, Mr. Fogarty receives the standard director pay package outlined above plus a $250,000 annual fee differential for his service as chairNon-Executive Chairman. The fee differential is paid in the form of the Audit Committee beginning on July 12, 2017.an additional annual cash retainer of $50,000 and additional restricted stock units with a grant date fair value of $200,000.(2) (3)SECSecurities and Exchange Commission (“SEC”) rules, amounts shown present the aggregate grant date fair value of restricted share and restricted stock unit and stock awards granted to our non-employee directors during 2017,2023, calculated in accordance with FASB ASC Topic 718, excluding the effect of any estimated forfeitures.(4)As For information on the valuation assumptions made in the calculation of these amounts, refer to Note 21 to the audited consolidated financial statements in our Form 10-K for the fiscal year ended December 31, 2017, the following directors held outstanding stock options: Mr. Boyce, 380,765, and Mr. Vann, 7,618; the following directors held outstanding restricted shares: Mr. Boyce 12,375,2023.(3) On March 7, 2023, Mr. Coxon forfeited 25,476 Mr. Craighead, 12,375, and Ms. Ross, 12,375; and the following directors held outstandingunvested restricted stock units: Mr. Coxon, 11,786, and Mr. Vann, 11,786.(5)Represents amounts paid to Mr. Boyce under the Company’s performance-based annual incentive plan, the PQIP. Pursuantshares due to the terms of his agreement described above, Mr. Boyce’s target annual bonus for 2017 was 100% of his 2017 base salary. The actual award payable for 2017 to Mr. Boyce was based on the achievementfailure of the EBITDA targetsperformance condition associated with such restricted shares.(4) As an employee of INEOS and in accordance with our non-employee director compensation policy, Mr. Ginns did not receive compensation for his service on our Board in 2023. Mr. Ginns resigned from the two operating segments: 50% Performance Materials & Chemicals Group and 50% Environmental Catalysts & Services Group pursuant to the same formula and basedBoard effective on the same financial targets and achievement levels under which the named executive officers earned their PQIP awards, all as discussed above under “Annual Performance-Based Cash Award – The PQIP”.December 31, 2023.(5) (6)IncludesAs an employee of CCMP and in accordance with our non-employee director compensation policy, Mr. Walsh did not receive compensation for his service on our Board in 2023. Mr. Walsh resigned from the Company’s matching contribution under the 401(k) plan ($8,100), the Company’s 4% contribution under the 401(k) plan ($10,800), the Company’s contribution to the PRA SERP ($21,579), and amounts in respect of tax preparation services ($44,676).Board effective on May 10, 2023.12

20182024 PROXY STATEMENT

2017, our2023, the Board held five5 meetings and actedalso approved certain actions by unanimous written consent ten times.consent. During 2017,2023, each director attended 100% of Board meetings that were held and among committee meetings conducted in 2023, 100% attendance occurred at leastall but one of such meetings. As such, each director attended more than 75% of the Boardtotal number of meetings and the total meetings held by all of the Board and its applicable committees on which he or shesuch directors served during the periods that he or she served.in 2023. We encourage, but do not require, our directors to attend annual meetings of stockholders and all directors attended our 2023 annual meeting of stockholders.non-employeesuch directors to discuss issues of importance to the Company, including the business and affairs of the Company as well asand matters concerning management, without any member of management present. The Board has not formally selected a director to presideAs noted above, Mr. Fogarty presides over all such meetings. During 2023, the non-employee and independent directors met without management present at all meetingseach of non-management directors. Instead, atthe five regularly scheduled meetings of the non-management directors, the attendees designate a chairperson for each meeting.addition, the Corporate Governance Guidelines providean effort to ensure that the independentBoard members of the Board meet in executive session at least once per year at which only independent directors are present.Committees and Committee CompositionDuring fiscal 2017, the Board had four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Health, Safety and Environment Committee. The members of each committee are appointed by the Board and serve until their successor is elected and qualified, unless they are earlier removed or resign. In addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues. The table below provideshave adequate information about the membership of these committees during fiscal 2017:

and

Corporate

Governance(1)

and

Environment*Committee Chairperson(1)The Nominating and Corporate Governance Committee was formed in September 2017 in connection with our initial public offering.(2)Mr. Ginns served on the Audit Committee until December 2017. At that time, Mr. Coxon joined the committee.(3)Mr. Currie served on the Health, Safety and Environment Committee until December 2017. At that time, Mr. Ginns joined the committee.(4)Mr. Boyce resigned from the Board and from the Compensation Committee in December 2017.2018 PROXY STATEMENT

13

Audit Committee — The Audit Committee’s purpose, roles and responsibilities are set forth in a written charter adopted by our Board, which can be found in the Investors section of our website at www.pqcorp.com under “Corporate Governance.” The Audit Committee’s primary duties and responsibilities are to:appoint or replace, compensate and oversee the outside auditors, who will report directly to the Audit Committee, for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us;pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, subject to de minimis exceptions that are approved by the Audit Committee prior to the completion of the audit;review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the selection, application and disclosure of critical accounting policies and practices used in such financial statements; anddiscuss with management and the outside auditors any significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles, any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies.The Audit Committee currently consists of Kimberly Ross, Mark McFadden and Robert Coxon, with Ms. Ross serving as chairperson of the committee. Our Board has determined that Ms. Ross and Mr. Coxon each meet the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the governance and listing standards of the New York Stock Exchange. We intend to maintain compliance with the audit committee requirements of the Sarbanes-Oxley Act and the governance and listing standards of the New York Stock Exchange. Pursuant to such requirements, the Audit Committee must be composed of at least three members, all of whom must be independent within one year of September 28, 2017, the date of the prospectus used in our initial public offering. All of the members of the Audit Committee are financially literate and Ms. Ross is also considered an “audit committee financial expert” within the meaning of the applicable rules of the Securities and Exchange Commission.Compensation Committee — The purpose of the Compensation Committee is to assist the Board in fulfilling its responsibilities relating to oversight of the compensation of our directors, executive officers and other employees and the administration of our benefits and equity-based compensation programs. The Compensation Committee reviews and recommends to our Board compensation plans, policies and programs and approves specific compensation levels for all executive officers. The Compensation Committee currently consists of Timothy Walsh, Andrew Currie and Kyle Vann, with Mr. Walsh serving as the chairperson of the committee. Our Board has determined that each member of the Compensation Committee meets the independence requirements under the governance and listing standards of the New York Stock Exchange and are “outside directors” pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee’s purpose, roles and responsibilities are set forth in a written charter adopted by our Board, which can be found in the Investors section of our website at www.pqcorp.com under “Corporate Governance.”Nominating and Corporate Governance Committee — The purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to become members of the Board, recommend to the Board director nominees for the next annual meeting of stockholders, develop and recommend to the Board a set of corporate governance principles applicable to the Company oversee the evaluation of the Board and its dealings with managementoperations as well as appropriate committees ofgood governance practices, the Board receives regular education sessions or “Teach-Ins” from Company employees and review and approve all related party transactions. The Nominating and Corporate Governance Committee currently consists of Greg Brenneman, Andrew Currie and Martin Craighead, with Mr. Brenneman serving as the chairperson of the committee. Our Board has determined that each member of the Nominating and Corporate Governance Committee is independent as defined under the governance and listing standards of the New York Stock Exchange. The Nominating and Corporate Governance Committee’s purpose, roles and responsibilities are set forth in a written charter adopted by our Board, which can be found in the Investors section of our website at www.pqcorp.com under “Corporate Governance.”14

2018 PROXY STATEMENT

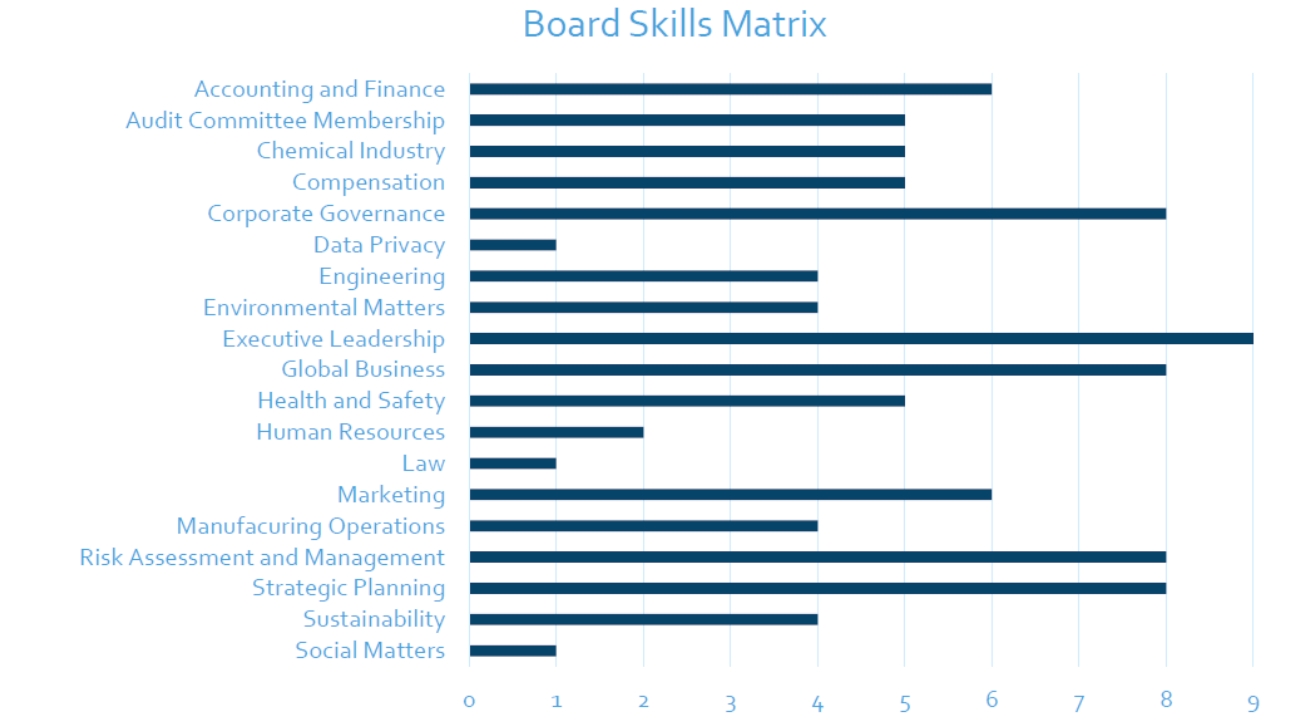

Health, Safety and Environment Committee — The purpose of the Health, Safety and Environment Committee is to assist the Board in fulfilling its responsibilities to provide global oversight of the Company’s health, safety, environment and security policies, processes and initiatives. The Health, Safety and Environment Committee currently consists of Robert Coxon, Jonny Ginns, Martin Craighead, Kyle Vann and Robert Toth, with Mr. Coxon serving as chairperson of the committee. The Health Safety and Environment Committee’s purpose, roles and responsibilities are set forth in a written charter adopted by our Board, which can be found in the Investors section of our website at www.pqcorp.com under “Corporate Governance.”Compensation Committee Interlocks and Insider ParticipationNone of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee. Mr. Walsh is employed by CCMP and Mr. Currie is employed by INEOS. For additional information regarding transactions between CCMP and its affiliates and us and between INEOS and its affiliates and us, see “Transactions with Related Persons.”Our Board’s Role in Risk OversightIt is management’s responsibility to manage risk and bringoutside advisors on various topics relating to the Board’s attention risks that are material to PQ. The Board has oversight responsibilityfunction for the systems establishedCompany. Those sessions have included educational presentations relating to report and monitor the most significant risks applicable to PQ. The Board believes that evaluating the executive team’s management of the various risks confronting PQ is one of its most important areas of oversight.In accordance with this responsibility, the Board administers its risk oversight role directly and through its committee structurerenewable fuels and the committees’ regular reports to the Board at Board meetings. The Board reviews strategic, financial and execution risks and exposures associated with the annual plan and long-term plans, major litigation and other mattersCompany’s business in that may present material risk tosector, the Company’s operations, plans, prospects orresearch and development program, the Company’s reputation, acquisitions and divestitures, senior management succession planning and enterprise risk management. The Audit Committee overseesAdvanced Silicas product lines within the Advanced Materials & Catalysts segment, the Company’s internal audit functionvirgin acid product lines, the Company’s Enterprise Risk Management program and reviews risks associated with financialvarious corporate governance topics. Directors also are encouraged to participate in director education programs other than those sponsored by the Company in order to stay abreast of governance best practices, emerging issues and accounting matters, including financial reporting, accounting, disclosure, internal controls over financial reporting, ethics and compliance programs, and regulatory compliance. The Compensation Committee reviews risks related to executive compensation and the design of compensation programs, plans and arrangements.suchthe number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the New York Stock Exchange and Securities and Exchange CommissionSEC rules. Under our Corporate Governance Guidelines, an “independent” director is one who meets the qualification requirements for being an independent director under applicable laws and the corporate governance listing standards of the New York Stock Exchange. Our Board evaluates any relationships between each director or nominee and PQEcovyst and makes an affirmative determination whether or not such director or nominee is independent. As a result of this review, our Board has affirmatively determined that each current member of our Board, with the exception of Mr. Gentilcore,Bitting, our Chairman, President and Chief Executive Officer, is independent under applicable laws and the corporate governance listing standards of the New York Stock Exchange.We seek to have a Board that represents diversity as to experience, gender and ethnicity/race, but we do not have a formal policy with respect to diversity. We also seek a Board that reflects a range of talents, ages, skills, character and expertise, particularly in the areas of leadership, operations, risk management, accounting and finance, strategic planning and the industries in which we operate, sufficient to provide sound and prudent guidance with respect to our operations and interests.20182024 PROXY STATEMENT

1513

* Committee Chair (1) Mr. Ginns served on the Compensation Committee and the Health, Safety, Environment and Security Committee for the entirety of 2023, but he resigned from our Board and those committees effective at the close of business on December 31, 2023. (2) Mr. Walsh served as Chair of our Compensation Committee from January 1, 2023 through May 10, 2023, when he resigned from our Board and did not stand for re-election at our 2023 annual meeting of stockholders. (3) Mr. Fogarty served as Chair of our Nominating and Corporate Governance Committee during the entirety of 2023; on January 1, 2024, Ms. Catalano became Chair of the Nominating and Corporate Governance Committee. (4) Mr. Bradley became Chair of our Compensation Committee effective May 10, 2023 and served in such capacity through December 31, 2023. Ms. Catalano became a member of our Compensation Committee on January 1, 2024.

(i) no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary date of the prior year’s annual meeting, or (ii)except that if there was no annual meeting in the prior year or if the date of the current year’s annual meeting is more thanset for a date that is not within 30 days before or after theof such anniversary date, we must receive the notice no later than the close of business on the prior year’s annual meeting, on or before 10 days aftertenth day following the day on which the date of the current year’s annual meeting is first disclosed in a public announcement. Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, biographical information and the information required by Section 1.2 of our Bylaws. Recommendations should be sent to c/o Secretary, PQ Group HoldingsEcovyst Inc., Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355. The Nominating and Corporate Governance Committee evaluates candidates for the position of director recommended by stockholders in the same manner as candidates from other sources. The Nominating and Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources.time, who may also be an executive officertime. Prior to April 2022, the roles of the Company. Michael Boyce, our former non-executive Chairperson, retired from the Board in December 2017. At that time, James Gentilcore, our PresidentChairman and Chief Executive Officer assumedwere combined. In April 2022, the additional role ofBoard decided to decouple these positions, and therefore the Company’s Chief Executive Officer no longer serves as Chairman. Instead, a non-employee director, Mr. Fogarty, was elected as our Board Non-Executive Chairman in April 2022 and he continues to serve in that capacity. As non-Executive Chairman, Mr. Fogarty has the power to call meetings of the Board. Given Mr. Gentilcore’s extensive experienceindependent directors and deep knowledge of our Company and our industry, theto preside over such meetings. The Board believes that combiningutilizing a Non-Employee Chairman and the Chairperson and Chief Executive Officer positionsexercise of key Board oversight responsibilities by independent directors is currently the most effective leadership structure for PQ. As Chief Executive Officer, Mr. Gentilcore is intimately involved in the day-to-day operationsbest interest of our stockholders.is best positionedits stockholders to leadpropose the BoardCharter Amendment to phase in settingannual election of directors beginning in 2025, with the strategic focusdeclassification process being completed at the 2027 annual meeting of stockholders. For more information about the Charter Amendment and direction for our Company.the Board’s recommendation to stockholders to approve the Charter Amendment, please see the description of Proposal 5 below.16

2018 PROXY STATEMENT

other than the Chief Executive Officer, who is also an employee of the Company, shall offerbe deemed to have offered his or her resignation from the Board to the Nominating and Corporate Governance Committee at the same time he or she retires, resigns or resignsis terminated from employment with the Company. In addition, it is our policy that directors who retire or otherwise change from the principal occupation or background association they held when they were originally invited to the Board should provide notice to the Nominating and Corporate Governance Committee or the Board and offer to resign from the Board. The Board does not believe that such directors should necessarily leave the Board, but it is our policy that there should be an opportunity for the Board to review the continued appropriateness of such director’s membership under these circumstances.PQ Group HoldingsEcovyst Inc., Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355. The Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board.Code of ConductWe have adopted a written Code of Conduct applicable to all employees and a written Code of Ethics for Senior Executive and Financial Officers, which are designed to ensure that our business is conducted with integrity. These codes cover, among other things, professional conduct, conflicts of interest, accurate recordkeeping and reporting, public communications and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. We intend to disclose any future amendments to, or waivers from, these codes of ethics for PQ executive officers within four business days of the waiver or amendment through a website posting or by filing a Current Report on Form 8-K with the Securities and Exchange Commission.2018 PROXY STATEMENT

17

EnvironmentSecurity Committee are available by clicking on “Corporate“Management & Governance” in the Investors section of our website,www.pqcorp.com. www.ecovyst.com. These materials are also available in print free of charge to stockholders, upon written request to c/o Secretary, PQ Group HoldingsEcovyst Inc., Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355.18

20182024 PROXY STATEMENT

AprilMarch 1, 2018,2024, of our current executive officers. James F. GentilcoreKurt J. Bitting 6548 Chairman of the Board, President and Chief Executive Officer and Director CrewsFeehan 5148 Executive Vice President and Chief Financial OfficerScott Randolph55Executive Vice President and Group President—Performance Materials and Chemicals David J. TaylorPaul Whittleston 6149Executive Vice President and Group President—Environmental Catalysts and ServicesJohn Lau63Chief Technology Officerand President — Advanced Materials & Catalysts 5258Vice President, Secretary and General CounselWilliam J. Sichko, Jr.64 Paul FerrallColleen Grace Donofrio 6165 Senior Vice President—StrategicPresident — Environment and Sustainability President and Chief Executive Officer, James F. Gentilcore, who also serves as Chairman of our Board, is set forth above under “Board of Directors.”CrewsFeehan became our Executive Vice President and Chief Financial Officer in August 2015.2021. From 2008 to 2015, Mr. Crews was Executive Vice President and Chief Financial Officer at Peabody Energy Corporation. From 1998 to 2008, Mr. Crews held various management positions at Peabody Energy Corporation including Vice President—Operations Planning, Assistant Treasurer and Director—Financial and Capital Planning. Mr. Crews began his career in KPMG’s audit function.Scott Randolph became Executive Vice President and Group President—Performance Materials and Chemicals in December 2016. From MarchMay 2016 to December 2016,August 2021, Mr. Randolph served as Vice President and President—Global Performance Chemicals after previously serving as Vice President and President—Performance Chemicals Americas and Australia and Performance Materials. From April 2005 to May 2016, Mr. Randolph served as President of Performance Materials. Mr. Randolph originally joined us as Senior Vice President Strategic Planning in February 2005. From 2000 to 2005, Mr. Randolph held the position of Chief Financial Officer with Peak Investments, LLC. From 1990 to 2000, Mr. Randolph held a number of management positions with Harris Chemical Group and IMC Global following IMC Global’s acquisition of Harris Chemical Group. Mr. Randolph’s last position with IMC Global was General Manager of the Worldwide Boron Business. From 1989 to 1990, Mr. Randolph held management positions with General Chemical. Prior to that, Mr. Randolph served as a nuclear trained naval officer from 1984 to 1989.David J. Taylor became our Executive Vice President and Group President—Environment Catalysts and Services in April 2018. From September 2017 through March 2018, Mr. TaylorFeehan served as our Senior Vice President—Strategic Development.President of Finance and Treasurer, and prior to that served as our Corporate Controller beginning in 2008 after joining in 2006. Prior to joining us, Mr. TaylorFeehan served as Director of Finance and Corporate Controller for Radnor Holdings Corporation, and began his career in several senior management positionspublic accounting with Air ProductsArthur Andersen and Chemicals, Inc., a global industrial gas and chemicals supplier. From 2014 to 2016, he wasKPMG.Energy from Waste and from 2005 to 2014 he wasPresident—Catalyst Technologies in January 2023. Mr. Whittleston served as our Vice President Energy Business.of Strategy and Business Development from September 2022 to December 2022. From May 2021 to June 2022, Mr. TaylorWhittleston served as Vice President Large Air Separation Unitsat SI Group UK Ltd., and from 2003September 2016 until July 2020 Mr. Whittleston served as Managing and Operations Director at TI Fluid Systems plc and he also previously worked at BASF.2005August 2022, Mr. Vann worked at W.R. Grace and Company, where he served as Vice President, Global Sales and Vice President, Industrial Chemicals Division from 2002 to 2003.Americas and Asia Pacific. Prior to that, Mr. Taylor held several operationalVann worked at BASF SE and business development roles with Air ProductsEngelhard Corporation, leading teams in the industrial gasareas including commercial, manufacturing and energy businesses.John Lauprocurement. Mr. Vann is also a United States Army veteran.TechnologyAdministrative Officer, General Counsel and Secretary in January 2016. Dr. Lau joined us in July 1996 to lead our Exploratory Research department with the mission to develop new growth opportunities. Dr. Lau was appointed2023 after having served as Vice President, of Research and Development in 1998 and Vice President of Strategic Planning in 2005. In November 2006,2018 PROXY STATEMENT

19

Dr. Lau became Vice President and General Manager of Silica Catalysts and Zeolyst International and, in January 2011, became President of the Catalysts business. Prior to joining us, Dr. Lau held various research and management positions at W.R. Grace & Co. from 1984 to 1996. From 1982 to 1984, Dr. Lau was a research fellow at the University of California, Los Angeles.Joseph S. Koscinski became Vice President, Secretary and General Counsel inand Secretary from November 2015.2015 to December 2022. From August 1995 to October 2015, Mr. Koscinski was an attorney in the Business Services Group of Babst, Calland, Clements and Zomnir, P.C., a law firm in Pittsburgh, Pennsylvania, where he was named a shareholder in 2003 and where his corporate practice included mergers and acquisitions, real estate matters and commercial contracts. While in private practice, Mr. Koscinski served as our outside corporate counsel to PQ Corporation since 2005.

William J. Sichko, Jr.

AdministrativeHuman Resources Officer in 2005. Mr. SichkoJanuary 2024. She has a long successful career in human resource management. Prior to Ecovyst and from July 2019 until January 2024, Ms. Thornton served as our Secretary from 2005 to November 2015, and is currently an Assistant Secretary. From 1998 through 2005, Mr. Sichko was Chief Administrative Officer with Peak Investments, LLC. From 1991 through 1998, he held management positions with Harris Chemical Group and IMC Global following IMC Global’s acquisition of Harris Chemical, including serving as Senior Vice President of Human ResourcesHR at Neuronetics, a public medical device company based in Malvern, Pennsylvania. Her career also includes HR roles at Sun Pharmaceutical Industries from 1996 to 1998. From 1987 to 1991, Mr. Sichko was a manager with General Chemical.Paul Ferrall became Senior Vice President—Strategic Development in April 2018. FromMay 2018 until July 2019, DSM North America from August 2008 until May 2018, and Johnson & Johnson from December 2016 through March 2018, Mr. Ferrall served as our Executive Vice President and Group President—Environmental Catalysts and Services. Mr. Ferrall joined us in July 2005 as Senior Vice President of Global Plant Operations for the performance chemicals business and served as Vice President and President—Performance Chemicals Americas and Australia from November 2006 to2004 until August 2015, prior to transitioning to President of Refining Services in August 2015.2007. Prior to joining us, Mr. Ferrall had beenthat, she held HR roles at Bayer Healthcare and Sankyo Pharma. At Ecovyst, Ms. Thornton is responsible for leading and evolving all facets of the president of Peak Chemicalhuman resources function including recruiting, talent development, compensation and Sulfurbenefits, and from 1995 to 2000, held several management positions with Harris Chemical Group and IMC Global, including Vice President of its Soda Products business. From 1978 to 1995, Mr. Ferrall held various positions of responsibility in engineering, operations, finance, sales and business management with Allied Chemical.2028

20182024 PROXY STATEMENT

29, 201821, 2024 by:135,240,866116,991,445 shares of Common Stock outstanding as of March 29, 2018.Securities and Exchange Commission.SEC. These rules generally attribute beneficial ownership of shares to persons who possess sole or shared voting or investment power with respect to such shares. The information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, the number of shares of Common Stock deemed outstanding includes shares issuable upon the exercise of options and held by the respective person or group which may be exercised or converted within 60 days after March 29, 2018 as well as shares of restricted stock of which a respective person has voting power. These21, 2024. Such shares are deemed to be outstanding and beneficially owned by the person holding those options for the purpose of computing the percentage ownership of that person or entity, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person or entity.PQ Group HoldingsEcovyst Inc., Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355. The inclusion in the following table of those shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner. Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed, except for those jointly owned with that person’s spouse.

of Shares 20182024 PROXY STATEMENT

2129